US efforts to counterbalance Chinese imports could instead create unsteadiness in the country’s fight against inflation, S&P Global Intelligence wrote.

In fact, Washington’s embrace of tariffs on foreign goods could risk delaying long-awaited interest-rate cuts, in the event it forces the Federal Reserve to keep policy higher for longer, the ratings agency said.

Tariff policies have gained fresh attention in recent months, especially with the US presidential election drawing closer. In order to protect domestic industry, both candidates have embraced protection, with former president Donald Trump going as far as pledging a 10% universal tariff on all US imports, if elected. As for China, he plans a 60% rate.

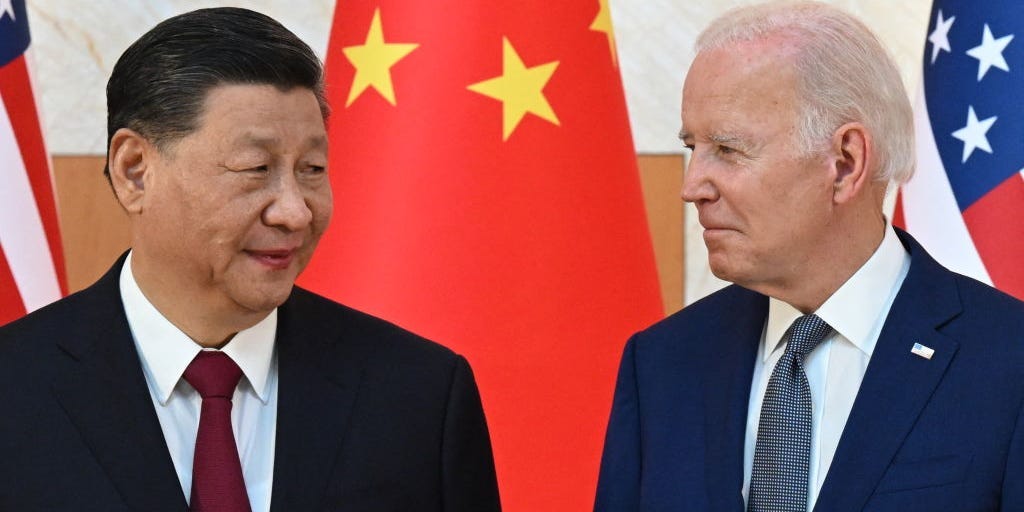

Though President Biden’s policies are less broad-based, his administration hasn’t shied away from protectionist tactics, either. Not only has Biden kept most of Trump’s previous trade restrictions on China intact, he’s recently announced new duties on Beijing’s technological exports — from electric vehicles to solar products.

“Yet economists say the new duties, and tariffs more broadly, may carry an unwelcome consequence: higher prices and a heightened probability of higher-for-longer interest rates,” S&P wrote. “While the Fed is expected to slightly lower benchmark rates this year from their current decades-long high, higher tariffs are likely to feed through to higher prices, complicating central bankers’ decisions.”

As of right now, Biden’s proposed tariffs will target only a small scope of China’s industry, going into effect through 2024 to 2026. Of the 14 categories under scrutiny, the top five accounted for just 3% of Chinese imports into the US in 2022, S&P cited.

But for domestic manufacturers, tariffs can ease the pressure to lower prices, as Chinese competitors lose their low-cost advantage. In this sense, protectionism can boost economic growth in the long run, but not before fueling market inefficiencies and complicating inflation.

“Global supply chains have developed to how they are today to take advantage of efficiencies in production. This keeps world and US GDP higher and prices lower than would exist without globalization and trade,” S&P’s senior US economist Ben Herzon said in the report.

What’s more, these tariffs have the potential to dent US growth, the agency estimates. Currently, GDP is expected to rise by 2.49% this year, just below last year’s 2.54% gain.

Other analysts have voiced the same concerns, especially if Trump’s blanket tariffs take effect. By one estimate, his proposal could cost US consumers $500 billion a year.

Read the full article here