The S&P 500 index hit yet another record high on Wednesday, and the debate about what will happen next is raging.

The index has surged 34% over the past 12 months to 5,781.

Don’t miss the move: Subscribe to TheStreet’s free daily newsletter

Last week’s employment report encouraged the bulls. Nonfarm payrolls rose 254,000 in September, up from 159,000 in August. And the unemployment rate dipped to 4.1% from 4.2%.

A strong economy makes for strong earnings, which boosts the stock market.

After the jobs data, “markets can have confidence to maintain their recent euphoria and continue broadening out,” Lara Castleton, U.S. head of portfolio construction and strategy at Janus Henderson, wrote in a commentary.

Jobs report a ‘sigh of relief’ for the Fed

The number should reassure the Federal Reserve that it doesn’t have to continue large interest-rate cuts to save the economy from recession, experts said.

“The Fed will breathe a sigh of relief to see job growth pick up in September after a soft patch in the summer,” said Bill Adams, chief economist for Comerica Bank in Dallas. The central bank slashed rates by 0.5 percentage points last month.

Bulls also point to earnings. Analysts expect earnings per share for the S&P 500 to increase 4.2% in the third quarter from a year earlier, according to FactSet. That would represent a slowdown from 11.3% in the second quarter, but it’s still a solid number.

Related: Druckenmiller, Summers deliver blunt messages to Fed on interest rates

On the other hand, the bears say that the stock market’s heady gains have sent valuations to unsustainable levels.

As of Oct. 4, the S&P 500 traded at 21.4 times analysts’ earnings estimates for the next 12 months, FactSet says. That’s well above the five-year average of 19.5 and the 10-year average of 18.

And the employment statistics indicate the economy is at risk of too much growth (which could lift inflation) or too little growth, warns the Harvard economist Larry Summers. “With this data, ‘no landing’ as well as ‘hard landing’ is a risk the Fed has to reckon with,” he wrote on Twitter.

Today’s employment report confirms suspicions that we are in a high neutral rate environment where responsible monetary policy requires caution in rate cutting. With the benefit of hindsight, the 50 basis point cut in September was a mistake, though not one of great consequence.…

— Lawrence H. Summers (@LHSummers) October 4, 2024

Doug Kass doesn’t buy one key bull argument

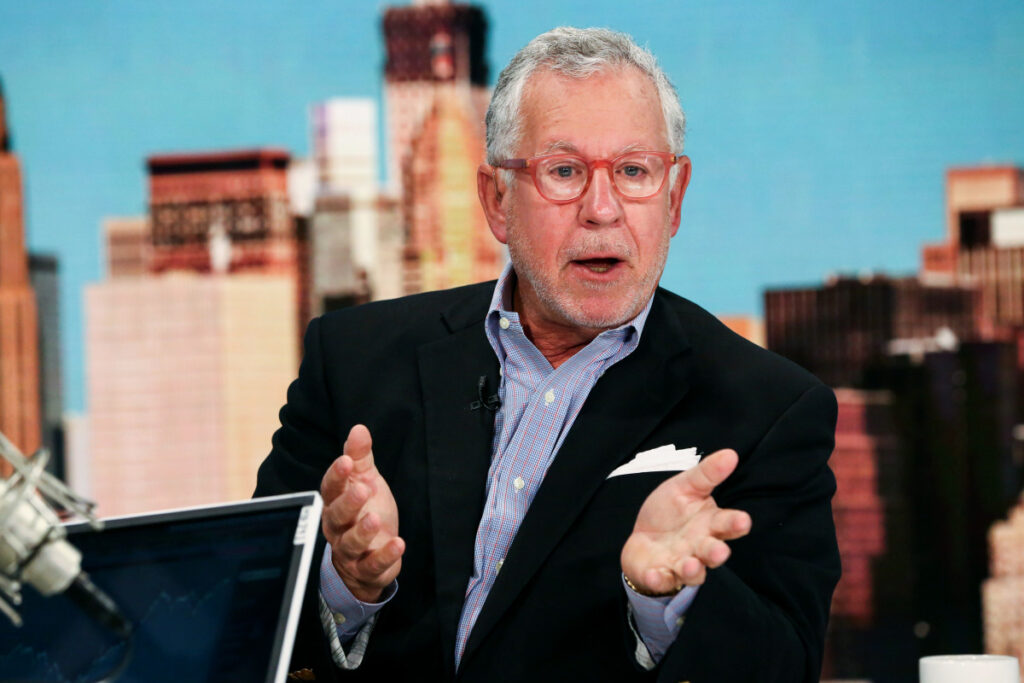

Meanwhile, the veteran hedge fund manager Doug Kass took umbrage with a bullish argument offered by Goldman Sachs analyst Scott Rubner last week.

Rubner, managing director for global markets at Goldman, wrote in a commentary cited by Bloomberg that investors tend to switch from cash to stocks after the uncertainty of presidential elections fades.

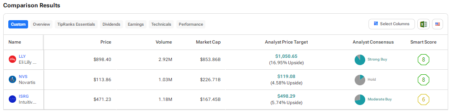

Related: Veteran investment strategist puts 3 top stocks in focus

But Kass, an analyst for TheStreet Pro who once worked as director of research for the legendary investor Leon Cooperman’s Omega Advisors, doesn’t buy the cash-on-the-sidelines argument.

“Based on history and as measured against the total market cap of equities, money markets provide far less firepower than is being argued,” wrote Kass.

Outgrowth of an ‘aging bull market’

“The cash-on the-sidelines argument is typically delivered in an aging bull market,” Kass said. “Moreover, whenever cash comes into equities from the sidelines, it usually signals a meaningful high or market top.”

He doesn’t deny that cash coming off the sidelines can positively affect stocks; he just doesn’t see it as a large one. “It will not be anywhere near enough to fuel a new market leg higher.”

Fund manager buys and sells:

While the sum total of money-market assets is rising, money-market assets as a percentage of S&P 500 market capitalization is falling, Kass said.

Also, while money-market-fund assets total a hefty $6.5 trillion, only $2.6 trillion of that comes from retail investors.

“Retail money market funds are at a multidecade low relative to total stock-market capitalization,” he said.

Data from Bank of America shows its clients have less than normal cash held, supporting Kass’s argument questioning if cash on the sidelines can really move stocks meaningfully higher.

BofA Global Investment Strategy

Also, money-market yields remain competitive, and “the public buys the most at the top,” Kass said.

Get Doug Kass’s daily stock buys and sells in TheStreet’s Diary. Join the conversation! Sign up for a $5 trial today.

-

Current strategies and actionable trade ideas — all on one dynamic platform built exclusively for active traders.

-

From sudden sell-offs to sudden spikes, TheStreet Pro arms you with crucial analysis — at a rapid-fire, professional pace — to help you make sound trading decisions — every day, every hour, and every minute.

-

Join Doug Kass for unique perspectives and breakthrough investment opportunities every day.

Read the full article here