-

Wall Street needs a new rhyme for “sell in May and go away.”

-

According to Carson Group’s Ryan Detrick, maybe an alternative is “buy in May and stay.”

-

That’s because stocks have historically moved higher during the summer period so many investors fear.

“Sell in May and go away” is an old Wall Street adage that highlights the fact that the stock market’s worst six-month stretch of performance is historically May through October.

But when you take a closer look at the numbers, they’re not all that bad, and certainly not bad enough to sell stocks simply because the calendar has flipped from April to May.

LPL Financial’s chief technical strategist Adam Turnquist highlighted that since 1950, average returns for the S&P 500 during this six-month period are actually positive, not negative, at +1.7%.

That number jumps to +4.0% when you look at the past 10 years.

“Unless investors can seek superior returns in other asset classes, being out of the equity market may not have been the best strategy, with stocks still delivering positive six-month returns, on average, over all the May-October periods studied,” Turnquist said in a recent note.

Carson Group market strategist Ryan Detrick also noted the positive returns during the stock market’s weakest six-month stretch of the year, and further added that May itself has been a relatively solid month for stocks, delivering positive stock market returns in nine of the past ten years, with an average gain of 0.7%.

Fundstrat’s Tom Lee also crunched the numbers and found that since 1985, “May has been a surprisingly good month.”

Lee highlighted that the month of May had delivered positive returns 77% of the time over the past 40 years, and the win ratio was even higher at 83% after a positive return in the first quarter and a negative return in April, as has happened this year.

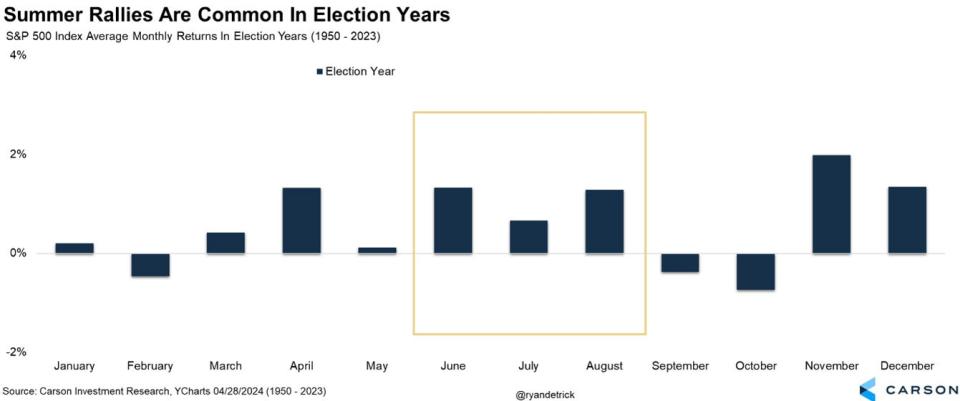

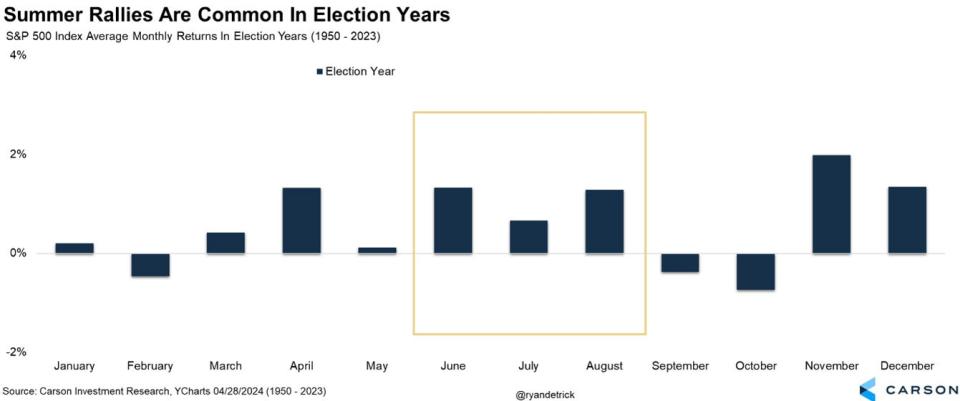

Finally, Detrick found that during Presidential election years like 2024, the stock market tends to see a summer rally ahead of the November rally, with the May through October period up 2.3% and higher 78% of the time.

“Buy in May and stay?” Detrick asked.

Read the original article on Business Insider

Read the full article here